Austrian Doctor Wins Tax Battle After €100K Pine Martens Invasion

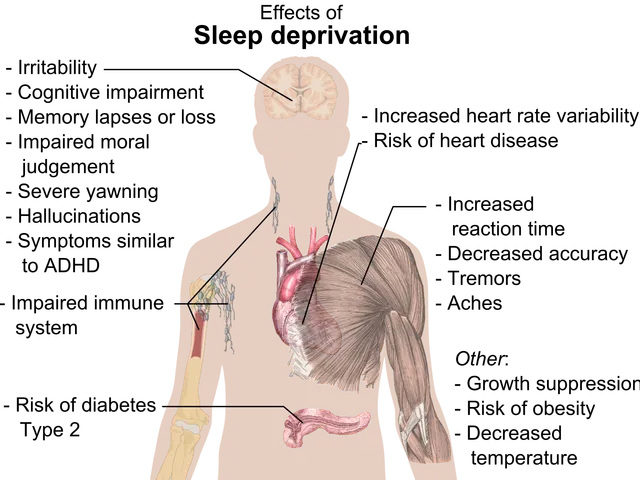

A doctor in Austria has won a tax dispute after spending nearly €100,000 to rid his home of pine martens. The infestation caused severe disruption, including sleep deprivation and extensive property damage. The case centred on whether the costs qualified as an 'extraordinary burden' under Austrian tax law.

The couple's two-family home became overrun with pine martens, leading to sleepless nights and significant structural harm. Disagreements arose between the owners over how to handle the costly renovations needed to resolve the issue.

The doctor, who owned part of the property, sought to deduct the €100,000 expense from his income tax under § 34 of Austria's Income Tax Act. He argued that the costs were a 'dr. extraordinary burden'—a category requiring expenses to exceed typical financial strain for most taxpayers.

The Federal Fiscal Court (BFG) examined the claim and ruled in his favour. It determined that the expenses met the criteria for an extraordinary burden but did not qualify as a natural disaster. The court also confirmed that the costs surpassed the income-based threshold for deductions.

However, the BFG allowed an appeal to the Administrative Court, referring the case for further review. This decision follows a series of stricter rulings on pest-related deductions, including a 2020 case in Vienna (VwGH 2020/04/0012) and a 2023 rodent infestation in Graz (VwGH 2023/02/0156), where courts denied claims unless the hardship was proven exceptional and unforeseeable.

The BFG's ruling permits the doctor to deduct the expenses, setting a precedent for similar cases. The decision highlights the challenges of proving 'extraordinary burden' under Austrian tax law, particularly for pest-related property damage. The case now moves to the Administrative Court for final review.