Medicover's Move to Boost Diagnostic Services Across Eastern Europe

Diagnostic lab services provider Synlab's operations in Romania, along with five other nations, have been acquired by Medicover.

Medicover has swooped in to snap up Synlab Group's operations in Romania, Turkey, Cyprus, Slovenia, Croatia, and North Macedonia, setting them back a cool €71.3 million. Here's the inside scoop on how this deal is set to beef up earnings, create sweet synergies, and expand Medicover's diagnostic empire.

Bottom Line Boost

The deal demonstrates financial foresight from Medicover, as it's projected to crank up revenues by roughly €80 million annually[4][5]. With these sweet numbers breezing past the company's targets, expect earnings per share to duke it out for higher ground.

Synergy Central

The theoretical cherry on top? Sky-high synergies between the two operations, setting Medicover's diagnostic services division on a fast track to profitability. Think enhanced operational efficiency, streamlined services, and a tidier procurement process across the board[5].

Market Domination

Market Majors

- Romania: Medicover's purchasing power turns Synlab's Romania operations into a valuable asset, promising growth in market share and an enriched service offering for laboratory diagnostics[3].

- Turkey ─ Who knew a deal centered on Eastern European markets would include an unexpected foray into Turkey's bustling healthcare market? Diversification here could translate into a wider pool of customers for Medicover[3].

- Croatia and North Macedonia ─ Medicover gets set to flex its muscles in both of these markets, with Synlab's operations becoming a valued part of the fold[1][4].

- Slovenia ─ Synlab's Slovenian operations might not be explicitly mentioned in the latest acquisition reports, but Strategic alignment between the two companies hints at this expansion move down the line.

The Expansion Scenario

This clever expansion plan brings Medicover one step closer to cementing its diagnostic services presence in Central and Eastern Europe. The spotlight lands squarely on Romania, with Turkey kicking off the New Kids on the Block crew. Stakeholders can't help but applaud the strategic move to bolster Medicover’s market standing and enhance service offerings across the board[1].

To Sum Up

Medicover's acquisition of Synlab Group operations sets the stage for a financial boost, synergistic gains, and a geographical expansion across Central and Eastern Europe, with potentially a Turkish twist too. Watch closely as Medicover becomes the undisputed king of diagnostic services in the region. 👑

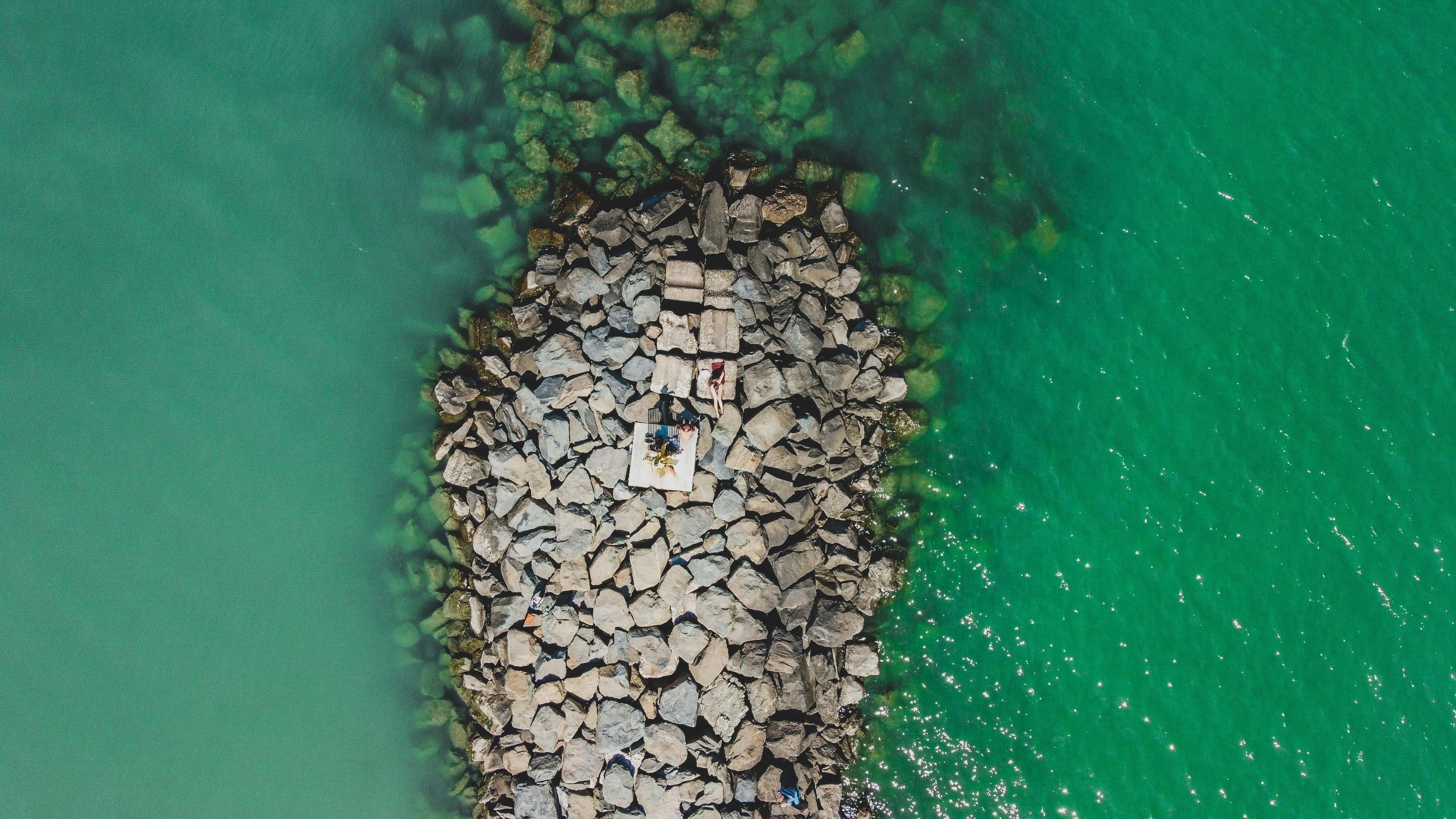

(Image: Medicover)

simona@our website

- The acquisition of Synlab Group's operations by Medicover in Romania, Turkey, Cyprus, Slovenia, Croatia, and North Macedonia is expected to increase Medicover's annual revenues by approximately €80 million, boosting earnings per share.

- The synergies between Medicover and Synlab's diagnostic services divisions could lead to enhanced operational efficiency, streamlined services, and a streamlined procurement process, setting Medicover's diagnostic services division on a fast track to profitability.

- Medicover's acquisition of Synlab's operations in Romania offers growth in market share and an enriched service offering for laboratory diagnostics, while Turkey's healthcare market presents an unexpected opportunity for diversification and a wider customer base.

- Medicover's strategic expansion plan, by acquiring Synlab's operations, brings the company one step closer to cementing its diagnostic services presence in Central and Eastern Europe.

- With this acquisition, Medicover is set to become the undisputed king of diagnostic services in Central and Eastern Europe, with the potential for a strong presence in Turkey as well.