Elderly Boomers Burning Through Inheritance Left for Their Children in Later Years - Elderly Baby Boomers Continually Blowing Through Their Kids' Inheritance - A Permissible Occurrence?

Millennials and Baby Boomers, two distinct generations, hold contrasting views on inheritance, shaping family finances and intergenerational wealth distribution.

### Divergent Financial Priorities

Baby Boomers, born between 1946 and 1964, prioritise long-term financial security, often saving and investing for retirement. They view inheritance as a means to secure their financial legacy and ensure the financial well-being of their heirs. On the other hand, Millennials, born between 1980 and 1995, focus more on immediate needs and experiences, viewing inheritance as a means to address current financial challenges or achieve financial flexibility.

### Traditional vs Modern Values

Baby Boomers tend to adhere to traditional values, emphasising the importance of leaving a financial and cultural legacy for their children. Millennials, however, prioritise personal fulfilment and social responsibility over traditional notions of inheritance.

### Implications for Family Finances and Wealth Inequality

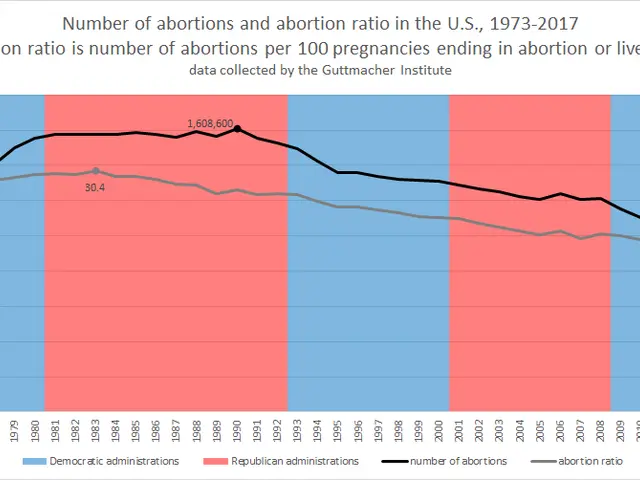

The differences in attitudes can lead to challenges in managing inherited wealth. Millennials might prefer more flexible financial instruments and investments, while Baby Boomers may prioritise long-term investments. The impending $45 trillion wealth transfer from Baby Boomers to younger generations will significantly influence the financial landscape. However, rising healthcare costs and other expenses may reduce the actual amount inherited, affecting the financial security of the next generation.

These differences can also exacerbate wealth inequalities, with the distribution of wealth across generations potentially widening the gap between those who inherit wealth and those who do not. The transfer of wealth has broader social and economic implications, leading to changes in consumer behaviour, investment strategies, and overall economic activity.

In summary, the differences in inheritance attitudes between Millennials and Baby Boomers reflect broader generational shifts in values and financial priorities. As wealth is transferred across generations, these differences will shape not only family finances but also the broader economic landscape.

The author, Leon Berent, argues against the notion that the size of an estate can measure the love of parents and does not want to fight over inheritance. However, he suggests that Baby Boomers should consider sharing their wealth with their children instead of squandering it. The author believes that the Boomer mindset is detrimental to family dynasties lasting longer than 80 years and contributes to the perpetuation of antisocial behaviour.

In Germany, where wealth inequality is more entrenched than in many other European countries, around 400 billion euros are inherited each year, contributing to wealth inequality. The rich plan their inheritances decades in advance, ensuring financial independence for their children. The neoliberal performance principle among Baby Boomers is considered pathological and toxic, with around 60 billion euros being passed down annually as inheritance in Germany.

- To bridge the intergenerational wealth gap, community policies should be implemented that encourage assets-based life plans for Millennials, focusing on wealth-management and personal-finance education.

- Employment policies can foster a healthier balance between immediate needs and long-term financial security, aligning with Millennials' lifestyle and mental-health priorities.

- Science, especially in the field of economics and psychology, can provide insights into family-dynamics and the impact of relationships on financial decisions, helping to foster more equitable inheritance practices.

- Health-and-wellness programs, facilitated by employers, can help Baby Boomers cope with the stress of wealth management, providing tools for wealth distribution that align with their values of financial legacy and security.

- Policies promoting lifelong learning and skill development can empower Millennials to take control of their financial futures, addressing current challenges and creating financial flexibility, without requiring inheritance.