Expressing Personal Discomfort: Fulfilling a Deceased Wife's Final Wish for Her Disagreeable Niece Leaves a Bitter Aftertaste for Eric

=============================================================

In a poignant tale of love, loss, and family, an individual finds themselves at a crossroads, faced with a difficult decision concerning their late wife's will. The individual's wife, who was diagnosed with pancreatic cancer, passed away 19 months after her diagnosis. During her treatment, the individual's daughter, a radiation oncologist, became their daily advocate, offering invaluable support.

Now, the individual is grappling with a decision between honoring their wife's original wishes in the will or giving the items to their daughter based on their interpretation of their wife's desires. The dilemma arises from the fact that the wife had designated a diamond tennis bracelet and diamond stud earrings to her niece in their updated wills. However, the niece did not reach out to her aunt during her illness, except for visiting her during the final two weeks.

The individual believes that their wife would have wanted their daughter to have the items if she had known about the niece's behavior during her illness and after her death. This belief is not without basis, as the individual's wife was able to attend her niece's wedding, a wish she held dear, before she passed away.

It is important to note that an executor generally cannot unilaterally change the distribution of personal items designated in a will. Their role is to follow the will's terms as written. However, the distribution can be altered if all the beneficiaries under the will agree to a change and petition the court for approval of this modification. Alternatively, beneficiaries can privately agree to redistribute items among themselves without court involvement, but this may have tax implications.

In this case, the individual is currently in control of the will and has the power to make changes. Yet, without unanimous consent or court approval, the executor cannot alter the distribution based on subjective judgments. To prevent such issues, it is advisable during estate planning for the testator to clearly express their wishes or create a trust with detailed instructions for distribution, potentially appointing a trustee with discretion.

This family's story serves as a reminder of the importance of clear and explicit estate planning. It highlights the complexities that can arise when personal items are involved and the need for careful consideration and communication within families. As the individual navigates this challenging decision, they are guided by the love and memories shared with their late wife, striving to honour her wishes while ensuring that her legacy lives on.

[1] Estate Planning & Probate Journal, "Altering a Will's Distribution: When and How" [2] American Bar Association, "Estate Planning: The Role of Trusts" [3] Forbes Advisor, "Can an Executor Change a Will?"

- As the individual grapples with the decision to alter their late wife's will, they might find solace in exploring resources such as the "Estate Planning & Probate Journal" article titled "Altering a Will's Distribution: When and How."

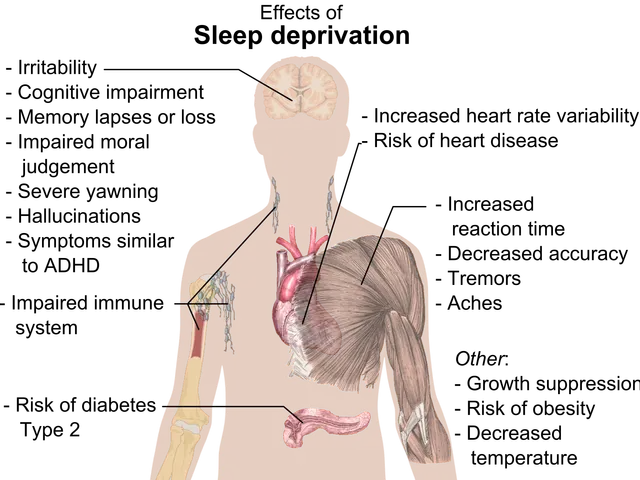

- In light of the family's complex dynamics and the value of mental health, it would be beneficial for the individual to seek advice from health-and-wellness professionals and consider how their lifestyle decisions may impact their relationships and family-dynamics during this challenging time.

- Amidst this emotional journey, the individual could ponder the role of trusts in estate planning, as suggested by the American Bar Association's resource "Estate Planning: The Role of Trusts," potentially providing a more flexible and mental-health-focused solution for the distribution of personal items.