General Mills slashes forecasts as weight-loss drugs reshape food demand

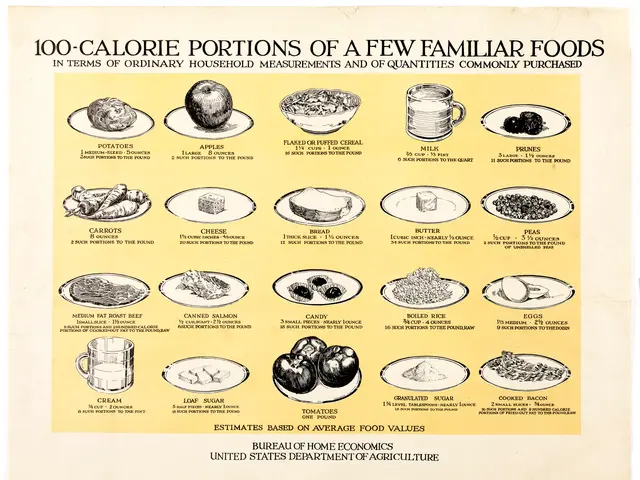

General Mills has warned that demand for its packaged foods is falling. The company now expects weaker sales and profits as consumers shift towards smaller portions and healthier options. A key factor is the rising use of GLP-1 weight-loss drugs, which are changing eating habits.

The firm has also cut its financial forecasts for the year, citing economic pressures and growing competition in the protein market.

The company's latest outlook shows a sharper decline than previously expected. Annual sales are now projected to drop by 1.5% to 2%, down from an earlier estimate of a 1% fall or slight growth. Adjusted operating profit and earnings per share are also set to fall by 16% to 20% in constant currency, worse than the prior forecast of a 10% to 15% decline.

CEO Jeff Harmening pointed to several challenges. Lower- and middle-income shoppers are prioritising value due to economic strain. At the same time, competition for protein-rich foods has intensified. The broader packaged food sector is struggling with weak consumer confidence, market instability, and shifting purchase patterns.

The impact of GLP-1 medications is adding to these pressures. These drugs, designed for weight loss, are pushing consumers toward smaller, more nutrient-dense meals. The global market for such treatments has evolved rapidly. Once seen as a blockbuster category, it now faces fierce competition, with price cuts and patent expirations driving down costs. In the US, semaglutide prices could fall by over 20% by 2026. Oral versions, like Novo Nordisk's Wegovy tablet, are also gaining traction, with over 18,000 prescriptions filled in its first week of launch in early 2026. Telehealth platforms are playing a bigger role in distribution, further reshaping the market.

General Mills is adjusting to a tougher market environment. The company's revised forecasts reflect lower demand for packaged foods, driven by economic pressures and changing consumer habits. With GLP-1 drugs and competition reshaping the food industry, the firm faces ongoing challenges in maintaining sales and profitability.