Hidden Financial Burden Potentially Endangering Your Retirement Savings

Preparing for health care expenses in your golden years is a must, as costs can mount faster than expected. To keep your retirement savings healthy, set aside more than necessary for medical bills.

Here's a look at some strategies that can help:

funding your retirement healthcare

Saving up with health savings accounts (HSAs)

HSAs offer triple tax advantages: contributions are tax-deductible, earnings grow tax-free, and withdrawals for medical needs are tax-free.[1] Consider using an HSA to put funds aside for healthcare, and think about investing the savings for growth. A proposed change may allow Medicare Part A enrollees to contribute to HSAs, providing extra savings for out-of-pocket expenses.[1]

Contributions to 401(k)s and IRAs

Both 401(k)s and IRAs offer tax advantages for retirement savings, although they are not designed explicitly for healthcare expenses.[3] Withdrawals can be used for any purpose, but they may be subject to penalties if made before age 59½.[3]

High-yield savings accounts (HYSAs)

HYSAs offer easy access to funds and are typically liquid, making them suitable for short-term savings or emergency funds.[5] Use HYSAs for quick access to cash to cover unexpected medical bills. As of May 2023, some banks offer up to 5.0% APY on HYSAs.[5]

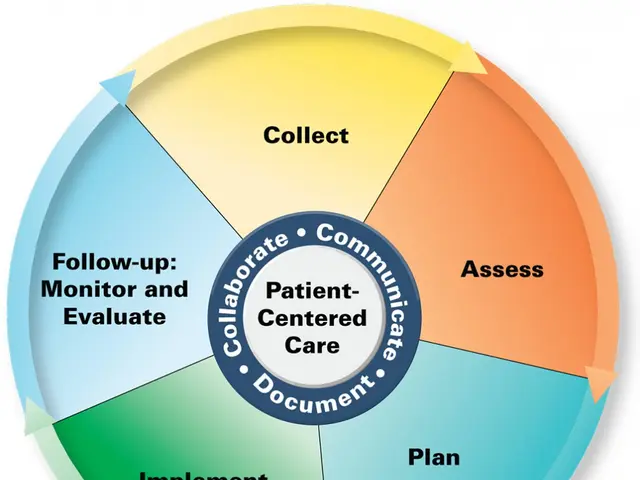

understanding healthcare coverage

Medicare

Get familiar with what Medicare covers and what it doesn't, as it may not cover all medical expenses.[1][5] Familiarize yourself with Medicare's different parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage).[5]

Supplemental Insurance (Medigap)

Medigap policies are designed to fill gaps in Medicare coverage, covering deductibles, copays, and coinsurance.[1][5] Consider purchasing a Medigap policy to ensure comprehensive coverage for unexpected healthcare expenses not covered by Medicare.[5]

Long-term care planning

Remember that Medicare generally does not cover long-term care, so consider options like long-term care insurance or hybrid policies.[5] Use vehicles like Qualified Longevity Annuity Contracts (QLACs) to allocate savings toward guaranteed income starting at an older age, such as 80, to help cover long-term care costs.[4]

Additional strategies

- Work Longer: Delaying Social Security benefits for higher payouts and allowing assets to grow is a smart strategy for a more secure retirement.[4]

- Manage Longevity Risk: Assess your longevity risk and ensure adequate funding throughout retirement.[4]

- Update Estate Planning: Keep estate planning documents current to ensure your financial wishes are respected in the future.[5]

- To supplement your retirement savings for healthcare expenses, you could explore investing in a token sale (ICO) for projects focusing on health-and-wellness or medical-conditions, as they might offer profitable returns that could fortify your finances.

- As you save for retirement, consider implementing wealth-management strategies, such as trading in financial markets, to potentially augment your savings and provide a more comfortable lifestyle in your golden years.

- Additionally, review your personal-finance plan to ensure it incorporates a high-yield savings account (HYSA), which can provide quick access to funds for unexpected medical bills, while still offering competitive interest rates.

- It would also be prudent to research tokenized assets in the science sector, particularly those targeting healthcare advancements, as their success could lead to promising returns and help ease the financial burden of healthcare costs in retirement.