How your money mindset and sleep habits could add years to your life

New research underscores how financial habits and mindset can shape both health and longevity. From the benefits of generosity to the impact of sleep, small changes in attitude and behaviour may add years to life. Experts also stress the importance of managing money wisely to mitigate stress and bolster well-being.

A positive approach to money can extend life. Studies indicate that viewing cash as a tool for enjoyment—not just survival—boosts immunity in later years. This mindset also reduces stress, which in turn supports better physical health.

Generosity plays a pivotal role too. Giving to family, friends, or charity triggers the release of oxytocin, often called the 'love hormone'. This helps the body stay relaxed and may lower the risk of chronic illness. Donating through Gift Aid even amplifies the impact, as charities claim an extra 25p for every £1 given.

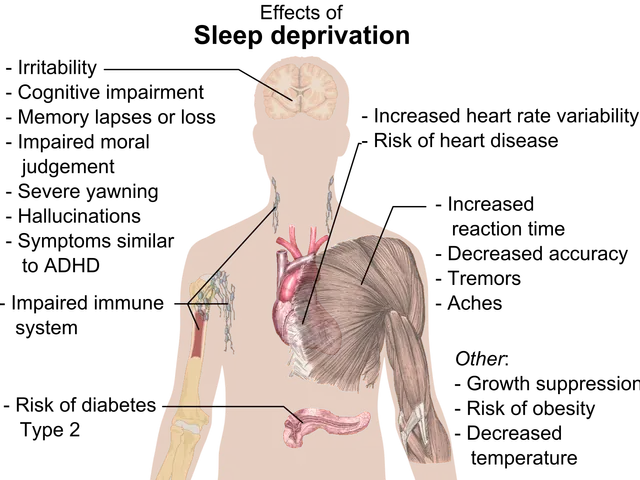

Sleep is another critical factor. US research found that men with consistent, good-quality sleep live nearly five years longer, while women gain an extra two years. Poor sleep, however, often links to financial stress—three in four people with money worries report sleepless nights. Beyond longevity, deep sleep aids skin health by producing proteins like collagen and elastin, which fight wrinkles and keep skin firm.

Financial planning also affects future security. According to Pensions UK, a single person needs £638,436 for a comfortable retirement, while a couple requires £732,872. Meanwhile, tax rules allow individuals to gift up to £3,000 annually without affecting inheritance tax. Organizations like Unbiased (unbiased.co.uk) offer advice to help people manage their finances more effectively.

Optimism itself can extend life. Studies reveal that positive thinkers live up to a decade longer than pessimists, with women gaining 15% more years and men 11%.

The connection between money, health, and longevity is evident. Good financial habits—like giving, saving, and reducing debt—can ease stress and improve sleep. Meanwhile, a positive outlook and smart planning may add years to life while enhancing well-being. For those seeking guidance, resources like Unbiased provide support to make informed financial decisions.