Potential Increase in IPT Discussed by Broadstone's Comments

The UK government is grappling with the prospect of increasing Insurance Premium Tax (IPT) in the upcoming Autumn 2025 Budget, a move that could have significant implications for both employers and employees. Currently standing at 12%, IPT is charged on most insurance policies and brought in £8.9 billion in 2024/25, an increase of 9% from the previous year.

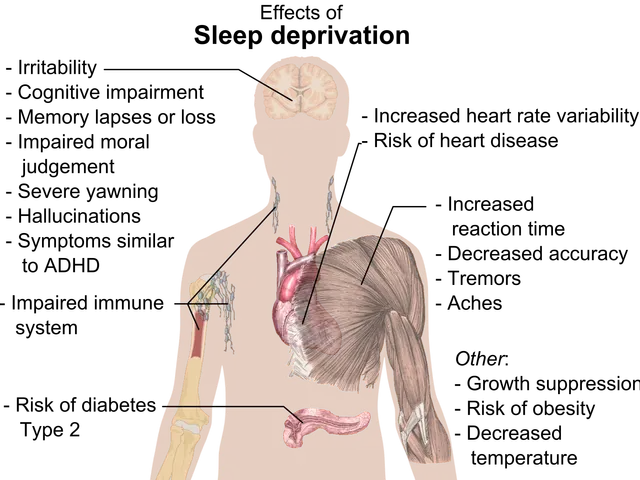

This potential increase comes at a time when the UK economy is facing challenges, with recent increases in economic inactivity due to long-term illnesses. Brett Hill, Head of Health & Protection at Broadstone, warns that an increase in taxes on the private health sector could be counter-productive, potentially exacerbating these issues.

Despite the potential economic concerns, the UK government is reportedly exploring further revenue-raising measures due to strained public finances. The government has already collected over £3bn from IPT in the first four months of 2024/25, and the latest HMRC data for IPT receipts and liabilities for the last complete financial year 2023 - 2024 has been released, showing an increase of 11% compared to the previous financial year.

However, Broadstone, a financial services consultancy, has voiced concerns against potential increases to IPT. An increase would have a 'double whammy' impact for company-funded health benefits, increasing costs for employers and employees' P11d tax liabilities. It could also lead to lower take-up of insurance benefits and reduced coverage levels, as people may choose to forgo insurance due to the increased costs.

The SPD leader and Finance Minister Lars Klingbeil has called for tax increases on the wealthy to close budget gaps. However, there are no specific statements from him or other government officials demanding a tax increase on private medical services. The current government stance or any concrete proposal to increase the IPT contribution rate is not detailed in the available sources.

Despite the potential revenue, the UK government is expected to resist the temptation of increasing IPT in the upcoming Budget, given the potential impact on the economy and the health sector. As the country approaches Labour's first Budget in over 15 years, everyone expects more taxes and frozen or cut thresholds. However, the decision on IPT remains to be seen.

One positive note is the improvement in NHS waiting lists since the General Election, falling by 253,912 people from July 2024 to June 2025, although they remain at unprecedented levels. This improvement may impact the need for private health insurance, potentially reducing the demand for insurance policies and, consequently, the need for IPT.

As the Autumn 2025 Budget approaches, the debate surrounding IPT continues, with concerns about its potential impact on the economy and the health sector weighing heavily on the minds of policymakers and the public alike.

Read also:

- Unveiled Footage Reveals Previously Unseen Aspect of Human Fertility

- Instructions for Utilizing Eight Tentacles: Octopuses commonly navigate and investigate using their forward appendages

- Ebola outbreak in the Democratic Republic of Congo results in 31 deaths; World Health Organization verifies 48 cases since its announcement earlier this month, marking the first occurrence in three years.

- Accident alerts issued for nosiest Alexandria crossroads due to 318 brush-with-death incidents