Sugar-free beverages granted tax relief

Taiwan's Legislature Passes Amendment to Exempt Sugar-Free Prepackaged Drinks from Commodity Taxes

In a bid to improve public health, the Legislative Yuan of Taiwan has passed amendments to exempt prepackaged drinks without added sugar from commodity taxes. This move is part of a bipartisan effort that aims to address the growing issue of obesity in the country.

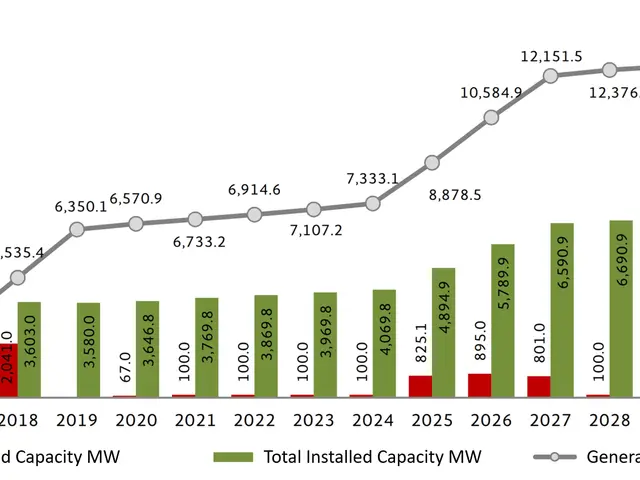

According to statistics, one in every three children in Taiwan is overweight, and half of adults experience weight problems. Sugary drinks are identified as a potential contributing factor to obesity, as suggested by Chang Chih-jen, honorary chairman of the Taipei-based Chinese Taipei Society for the Study of Obesity.

The amendments could have far-reaching implications, as they could encourage the consumption of low- or no-sugar options, thereby reducing sugar intake and related health harms. Tax policies that differentiate based on sugar content incentivize manufacturers to reformulate products with less sugar and consumers to choose healthier drinks.

Expanding the tax exemption to other drinks without added sugar could further improve public health. Chang Chih-jen suggests such an expansion as a means to promote healthier choices.

However, the issue of hand-shaken drinks, which often have variable sugar levels and ingredients, complicates taxation. Some jurisdictions exempt milk-based drinks due to calcium concerns, but recent proposals suggest removing these exemptions, given the net harm of excess sugar. For hand-shaken drinks, exemptions or thresholds could be considered if sugar content is demonstrably low or if the drinks contain significant beneficial nutrients, but clear standards and labelling would be necessary to avoid abuse of exemptions.

The change also removes the 13 percent commodity tax on color televisions, video recorders, record players, and audio recorders, as they have become essential consumer goods, questioning the fairness and legitimacy of levying taxes on them.

The ministry will work with consumer protection agencies and other institutions to monitor whether companies have passed on the benefits of the tax exemption to consumers. Higher taxes should be levied on shaken drinks with added sugar, according to Chang.

Lowering sugar intake through tax incentives on sugar-free drinks can reduce obesity, diabetes, and cardiovascular diseases, thereby lessening the burden of non-communicable diseases (NCDs). Reformulating drinks to fall below sugar tax thresholds has already led to reductions in sugar content since initial sugar levies were introduced. Tiered taxes based on sugar content, such as the UAE’s upcoming system, are proven to encourage the production and purchase of healthier drinks.

The Ministry of Finance will provide data on commodity and business taxes for imported and domestically produced beverages according to their price. The next step should be to expand the exemption to hand-shaken drinks for a consistent "sugar-free, tax-free" system, as suggested by Chang.

Taipei Medical University School of Nutrition and Health Sciences head Hsia Shih-min supports the new amendments and encourages consumers to choose sugar-free drinks for public health reasons. The legislature passed two resolutions related to the new amendments, including one for the Ministry of Finance to prepare a one-year assessment report on tax exemptions for household appliances.

[1] [Source] [2] [Source] [3] [Source]

- In light of the new amendment, the Ministry of Finance should provide data on sugar content for hand-shaken drinks to consider exemptions if they meet low sugar criteria or contain beneficial nutrients, promoting healthier choices and reducing chronic diseases such as obesity, diabetes, and cardiovascular diseases.

- The focus on health-and-wellness extends beyond tax exemptions for prepackaged sugar-free drinks to include a broader view on fitness-and-exercise, nutrition, and medical-conditions, as Taiwan grapples with the growing concerns of non-communicable diseases (NCDs).

- Look beyond simply exempting sugar-free prepackaged drinks; incorporating tax policies that encourage healthier consumer choices might also extend to reducing taxes on hand-shaken drinks with low sugar content and beneficial nutrients, fostering a culture of health-and-wellness and aiding in the management of chronic diseases like obesity, diabetes, and cardiovascular diseases.